wv estate tax return

Tax projection engagement letter. Form W706 Schedule TC-A Fill-In Form Tax Computation Schedule Fillable PDF -- For deaths on or after January 1.

This final estate tax return is necessary only when an estate is large enough-at least 114 million in assets as of 2019-to require payment of.

. All Major Categories Covered. For 2000-2001 the exemption equivalent was 675000. Tax Return Preparation 304 855-0009.

B Returns by personal representative. Worksheet for Molds Jigs Dies Forms Patterns and Templates. And like every US.

The schedule for determining whether an estate tax return is due can be found in the back of your appraisement booklet. IT-140 West Virginia Personal Income Tax Return 2021. 262 Crawley Creek Rd.

1 A return. Name A - Z Sponsored Links. The Department of Revenue administers and enforces West Virginia revenue laws including the regulation of insurance banking and gaming industries as well as.

STC-1232-C Commercial Business Property Return. Tax engagement letter 2022. Select Popular Legal Forms Packages of Any Category.

-- The personal representative of every estate subject to the tax imposed by this article who is required by the laws of the United States to file a federal estate tax return shall file with the Tax Commissioner on or before the date the federal estate tax return is required to be filed. 2023 Trend and Depreciation Trend and Percent Good Tables for Tax Year 2023. State West Virginia has its own unique set of laws governing inheritance.

Wv State Tax Return in Tornado WV. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now.

The exemption equivalents are. NRW-3 Information Report of 761 Non partnership Ventures. Striving to act with integrity and fairness in the administration of the tax laws of West Virginia the State Tax Departments primary mission is to diligently collect and accurately assess taxes due to the State of West Virginia in support of State services and programs.

NRW-2 REV 7-20 Statement of West Virginia Income Tax Withheld for Nonresident Individual or Organization 2020 Prior Year Forms. 2016 Pollution Abatement Control Equipment Preapproved Items Prior year forms. Payment of Additional Estate Taxes in WV.

2020 tax return engagement letter. Agreement sets forth the agreement between the FHWA and the State of West Virginia. Use the IT-140 form if you are.

The sigNow extension was developed to help busy people like you to decrease the burden of putting your signature on legal forms. Prior years are also listed in the appraisement booklet. Tax Information and Assistance.

2006 through 2008 2000000. Fillable-Forms Forms and Instructions Booklet Prior Year Forms. Department of Transportation State DOT on the roles and.

Address to which he would return if released from the care facility. OPT-1 Taxpayer e-File Opt Out Form. 2017 Supplemental Filing Instructions.

The depreciation schedule can be found on Form 4562 of your tax return. Federal estatetrust income tax return due by April 15 of the year following the. Start eSigning wv state tax department fiduciary estate tax return forms 2008 by means of tool and join the millions of satisfied clients whove already experienced the advantages of in-mail signing.

Gift tax return engagement letter. I The Internal evenue Service requires the filing of a r Federal Estate Tax return Form 706 for the estate of every citizen of the united States whose gross estate at the time of death was larger than the amount of the federal exemption equivalent. A real estate deputy assessor will be.

2022 STC-1232-I Supplemental Filing Instructions for the Industrial Property Return. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map. Although West Virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on the value of the estate.

Commerce over the territory of the state and therefore are exempt from ad valorem property tax and do not have a tax situs in West Virginia for purposes of ad valorem taxation. NRW-4 Nonresident Income Tax Agreement. Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance.

Mountain State Tax -. STC-1232-I Industrial Business Property Return. In addition to the individual tax return and the estate income tax return it may also be necessary for an executor to file a US Estate Tax Return Form 706.

2022 STC-1232-I Industrial Business Property Return. RC Certification of Exemption from Withholding upon Disposition of West Virginia. Article 10 Chapter 11 of the West Virginia Code.

Form W706 Schedule TC-A. Ad The Leading Online Publisher of National and State-specific Probate Legal Documents. Property Tax Forms and Publications.

A full-year resident of West Virginia A full-year non-resident of West Virginia and have source income mark IT-140 as Nonresident and complete Column C of Schedule A. Tax Computation Schedule -- For deaths on or after January 1 2005 and.

How To Complete The T776 Tax Form Statement Of Real Estate Rentals In 2022 Real Estate Rentals Tax Software Tax Forms

You Do Not Want To Miss Out On This Opportunity In Staten Island Http Www Defalcorealty Com Listing 1121577 80 Vulcan St Real Estate Outdoor Decor Estates

Will The Irs Extend The Tax Deadline In 2022 Marca

Gap Between Homeowners Appraisers Narrows To Lowest Mark In 2 Years Real Estate Nj Real Estate Articles Real Estate Houses

100 Piece Junk Journal Kit Diy Junk Journal Pages Ephemera Etsy Journal Paper Altered Art Projects Junk Journal

:max_bytes(150000):strip_icc()/IRSForm1310-ed524d9fd5f24019a95dee03140c5ac2.jpg)

Form 1310 Statement Of Person Claiming Refund Due A Deceased Taxpayer Definition

Preston County Commission Online Records

West Virginia Estate Tax Everything You Need To Know Smartasset

West Virginia Estate Tax Everything You Need To Know Smartasset

How To Start A Real Estate Business Infographic

/cloudfront-us-east-1.images.arcpublishing.com/gray/IZ3BMGMUABDQJGC3BGMFLVN5KM.jpg)

Making A Difference Residents Pay Nearly 1 Million In Property Taxes After Wsaz Story Airs

Chart Current Mortgage Closing Costs Listed By State Closing Costs Mortgage Interest Mortgage

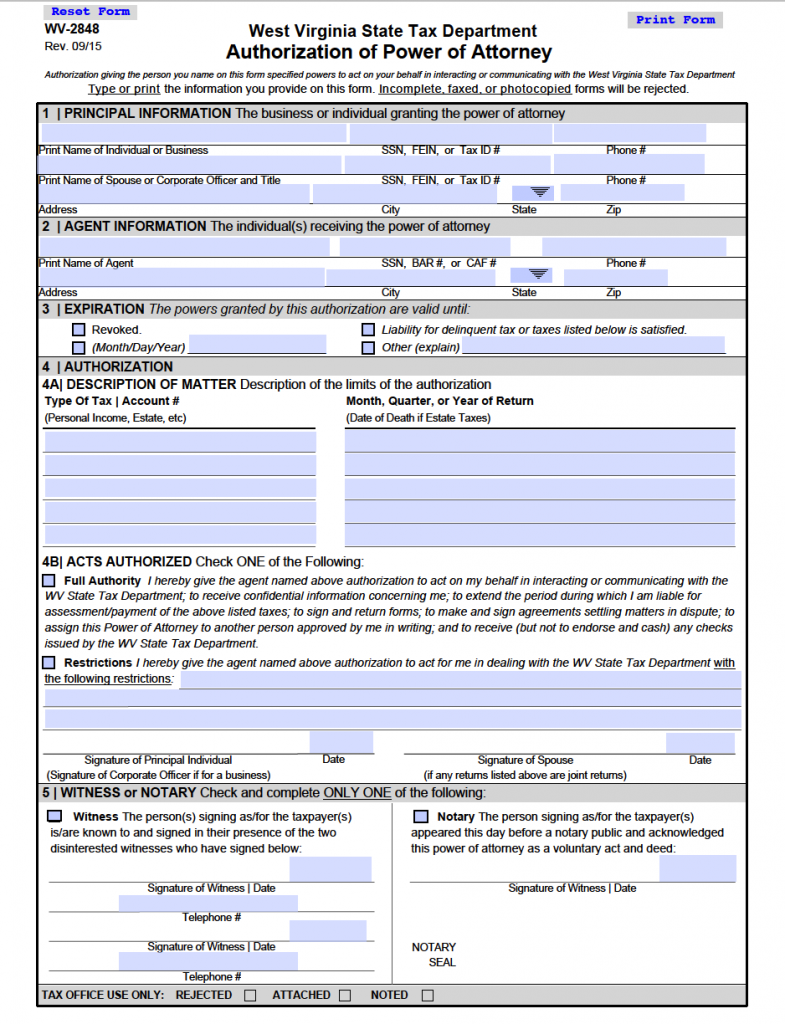

Free Tax Power Of Attorney West Virginia Form Adobe Pdf

Estate Taxes In Wv Filing A Final Estate Tax Return And Other Responsibilities Blog Jenkins Fenstermaker Pllc

Free West Virginia Tax Power Of Attorney Form Wv 2848 Pdf Eforms

37 States Don T Tax Your Social Security Benefits Make That 38 In 2022

West Virginia Estate Tax Everything You Need To Know Smartasset