ny paid family leave tax deduction

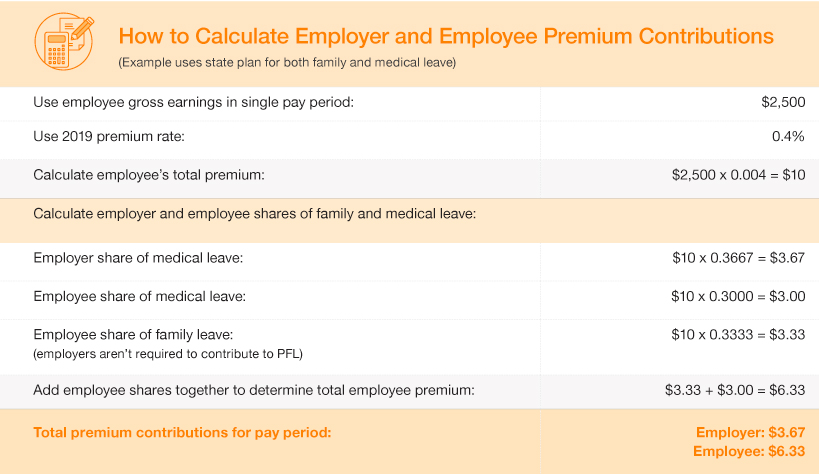

Tool found at PaidFamilyLeavenygovcost. Solution found The New York Department of Financial Services announced that the 2021 paid family leave PFL payroll deduction rate will increase to 0511 of an employees gross wages each pay period up from 0270 for 2020.

New York Paid Family Leave Benefit Level And Premium Rate Updates Announced For 2022 Harter Secrest Emery Llp

9-Click Next through the wizard until you get to the Taxes screen.

. Identifying Paid Family Leave Tax in TurboTax. These benefits must be secured through a carrier licensed to write New York State statutory disability. Now after further review the New York Department of Taxation and Finance has provided important guidance regarding payroll deduction and PFL taxation.

2022 Paid Family Leave Payroll Deduction Calculator. Employers may collect the cost of Paid Family Leave through payroll deductions. Ad Owe the IRS.

10-Select NY Paid Family Leave from the list of taxes. Paid Family Leave PFL Employee Fact Sheet PSB 440-16 Paid Family Leave for Represented Employees The deduction rate for 2022 is 0511 of an employees gross wages each pay period with a maximum annual contribution of 42371. The weekly contribution rate for New York Paid Family Leave is 0511 of the employees weekly wage capped at New York States current.

12-Make sure to press Finish. What Is Ny Paid Family Leave Tax. End Your Tax Nightmare Now.

In 2022 these deductions are capped at the annual maximum of 42371. 11-Click Next until you finish the wizard. Real Business Solutions Support Team Makers of W2 Mate 1095 Mate and Payroll Mate.

This amount is subject to contributions up to the annual wage base. Therefore a maximum contribution of 741 per week per employee in 2021 regardless of age gender or. Download a customizable template to notify your employees about the payroll deduction and the amount theyll pay.

If you are eligible for Paid Family Leave you pay for these benefits through a small payroll deduction equal to 0511 of your gross wages each pay period. Your employer will deduct premiums for the Paid Family Leave program from your after-tax wages. Employee Notice of Paid Family Leave Payroll Deduction for 2022 Author.

Reduce Your Back Taxes With Our Experts. Each employees total remuneration is the amount prior to any deductions including deductions for the premiums for New Yorks Paid Family Leave program. The state of New York communicated Paid Family Leave rates and initial payroll deduction guidance on June 1 2017.

Increased monetary pay out a shorter waiting period duration to collect benefits or a longer duration for benefits to be paid. A tax I paid not a benefit received TurboTax didnt recognize NY PFL so it asked me to select another description from their list else choose the. The maximum 2021 annual contribution will be 38534 up from 19672 for 2020.

This amount is be deducted from employees post-tax income and is appear on their paystubs as a post-tax deduction. Average weekly wage of 145017. Paid Family Leave is administered by the New York State Workers Compensation Board Created Date.

The maximum employee contribution in 2021 is 0511 of an employees weekly wage with a maximum annual contribution of 38534. Get answers to your questions or other assistance on Paid Family Leave by. Block 14 of my W-2 shows an amount for NY PFL that represents my contribution payroll deduction tax that I paid to NY Paid Family Leave.

Are benefits paid to an employee under the Paid Family Leave program considered remuneration that must be reported. Your premium contributions will be reported to you by your employer on Form W-2 in Box 14 as state disability insurance taxes withheld. Use the calculator below to view an estimate of your deduction.

You will receive either Form 1099-G or Form 1099-MISC from your employer showing your taxable benefits. No deductions for PFL are taken from a businesses tax contributions. You May Qualify for an IRS Forgiveness Program.

Employee-paid premiums should be deducted post-tax not pre-tax. Your information will not be saved if you do not click Finish. Employee Notice of New York State Paid Family Leave Payroll Deduction for 2022.

Enhanced Disability and Paid Family Leave Benefits. Paid Family Leave Helpline. An employer may choose to provide enhanced benefits such as.

Paid Family Leave PFL is now available to eligible employees of the City of New York. Employee Notice of Paid Family Leave Payroll Deduction.

What Is The Salt Deduction H R Block

Washington State Paid Family And Medical Leave The Standard

New York Paid Family Leave Benefit Level And Premium Rate Updates Announced For 2022 Harter Secrest Emery Llp

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Can You Deduct College Tuition On Your Federal Income Tax Return

Tax Season 2022 Are My Alimony Payments Tax Deductible

Biden S Build Back Better Will Raise Taxes On 30 Of Middle Class Families

New York State Paid Family Leave Law Guardian

Ny Paid Family Leave Opting Out Shelterpoint

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

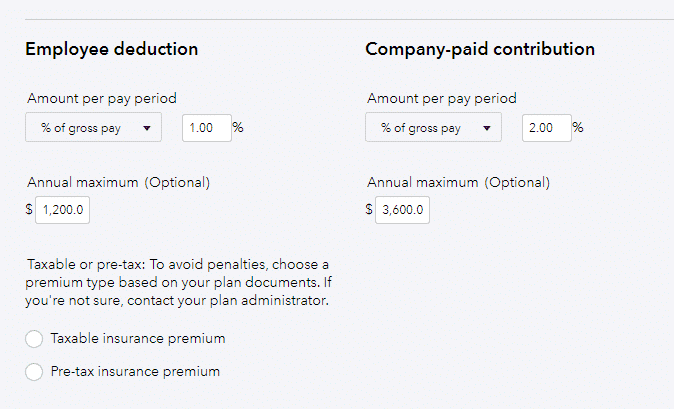

How To Choose And Set Up Benefits In Quickbooks Payroll

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Is Workers Comp Taxable Workers Comp Taxes

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post