workers comp filing taxes

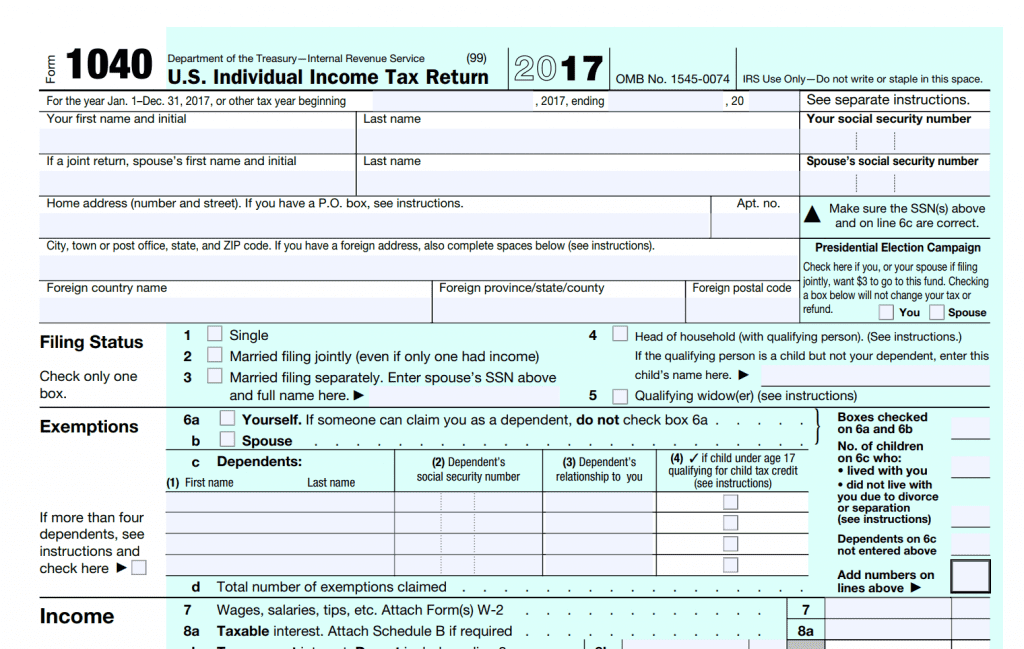

File original and one 1 copy with the Workers Compensation Commission -person or by mail or file online at Must be accompanied by a nonrefundable 50 filing fee payable to the WCC. This rate guide is published to assist you in comparison shopping for your workers compensation coverage.

Is Workers Comp Taxable In Nj Craig Altman

I _____ Name of individual.

. Because tax laws are often confusing lawyers frequently help people understand how taxes will impact their finances. Taxes and Workers Comp Benefits. CHECKS WILL NOT BE ACCEPTED.

Generally workers compensation benefits are exempt from taxes. Thus while a portion of your workers comp may considered taxable income in practice the taxes paid on workers comp are usually small or non-existent. However workers compensation settlements may have an effect on other taxable disability payments.

A company may choose to base its rates on its own independent company-specific relativities filed by the company or loss costs filed by the National Council on. Moreover an experienced workers compensation attorney may be able to structure your workers comp settlement in a way that minimizes the offset and reduces your taxable income. Listing of Companies by Group Filing Information.

In some cases a person may. ADMINISTRATIVE WORKERS COMPENSATION ACT. I _____ state under penalty of perjury as follows.

Are My Vermont Workers Compensation Benefits Taxed

Do I Pay Taxes On My Workers Compensation Settlement In Ohio

Do I Have To Pay Taxes On My Workers Comp Benefits

Is Workers Compensation Taxable In North Carolina Riddle Brantley

Is Workers Comp Taxable Income In Michigan What You Need To Know

Is Workers Comp Taxable Workers Comp Taxes

Are Maintenance Payments Taxable Does Maintenance Count As Income The Young Firm

Problems With Worker S Compensation Common Worker S Comp Issues

How To Deduct Workers Compensation From Federal Tax Form 1040